what is the income tax rate in dallas texas

Detailed Texas state income tax rates and brackets are available on this page. The Texas income tax has one tax bracket with a maximum marginal income tax of 000 as of 2022.

Those Darn Property Taxes Insights From Texas Tax Protests Haas News Berkeley Haas

The CFED chart is s based on 2007 data from the Institute on Taxation and Economic Policy and theres more information.

. The 825 sales tax rate in Dallas consists of 625 Texas state sales tax 1 Dallas tax and 1 Special tax. Texas state income tax rate for 2022 is 0 because Texas. Texas is No.

Texas income tax rate. Back in July I laid out for you a new setup in which you go to a state government website and tap out an email to your elected officials about the. 100 rows Dallas County is a county located in the US.

Texas state income tax rate for 2022 is 0 because Texas does not collect a personal income tax. Texas does not impose an income tax on corporations nor does it impose an individual state income tax. The median property tax in Dallas County Texas is 2827 per year for a home worth the median value of 129700.

If you make 55000 a year living in the region of Texas USA you will be taxed 9076. Texas income tax rate and tax brackets shown in the table below are. In terms of taxes Texas is one of the best states you can live in.

How Your Texas Paycheck Works. It is the second-most populous county in Texas and the ninth. Dallas County collects on average 218 of a propertys assessed.

Texas does have a corporate franchise tax based on earned. You can print a 825 sales tax table here. The minimum combined 2022 sales tax rate for Dallas Texas is.

As of the 2010 census the population was 2368139. What You Need to Know About Dallas Property Tax Rates. Texas does not have a corporate income tax but does levy a gross receipts tax.

The Texas Franchise Tax. Texas has no individual income tax as of 2021 but it does levy a franchise tax of 0375 on some wholesalers and retail businesses. Texas has a 625 percent state sales tax rate a max local sales tax rate of 200 percent and an average.

This is the total of state county and city sales tax rates. 8 hours ago1235 PM on Oct 6 2022 CDT. That means that your net pay will be 45925 per year or 3827 per month.

The median property tax in Dallas County Texas is 2827 per year for a home worth the median value of 129700. What is the sales tax rate in Dallas Texas. Texas Instruments Incorporated an 18B global semiconductor design and manufacturing company located in North Dallas is looking for an experienced Federal and.

Census Bureau Number of cities that have local income taxes. There is no applicable county tax. Theres no personal income tax and theres no.

Texas Income Tax Calculator Smartasset

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay

Tennessee Sales Tax Rate Rates Calculator Avalara

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

U S Cities With The Highest Property Taxes

Is There State Income Tax In Texas The Income Tax Percentage In Texas Is 0

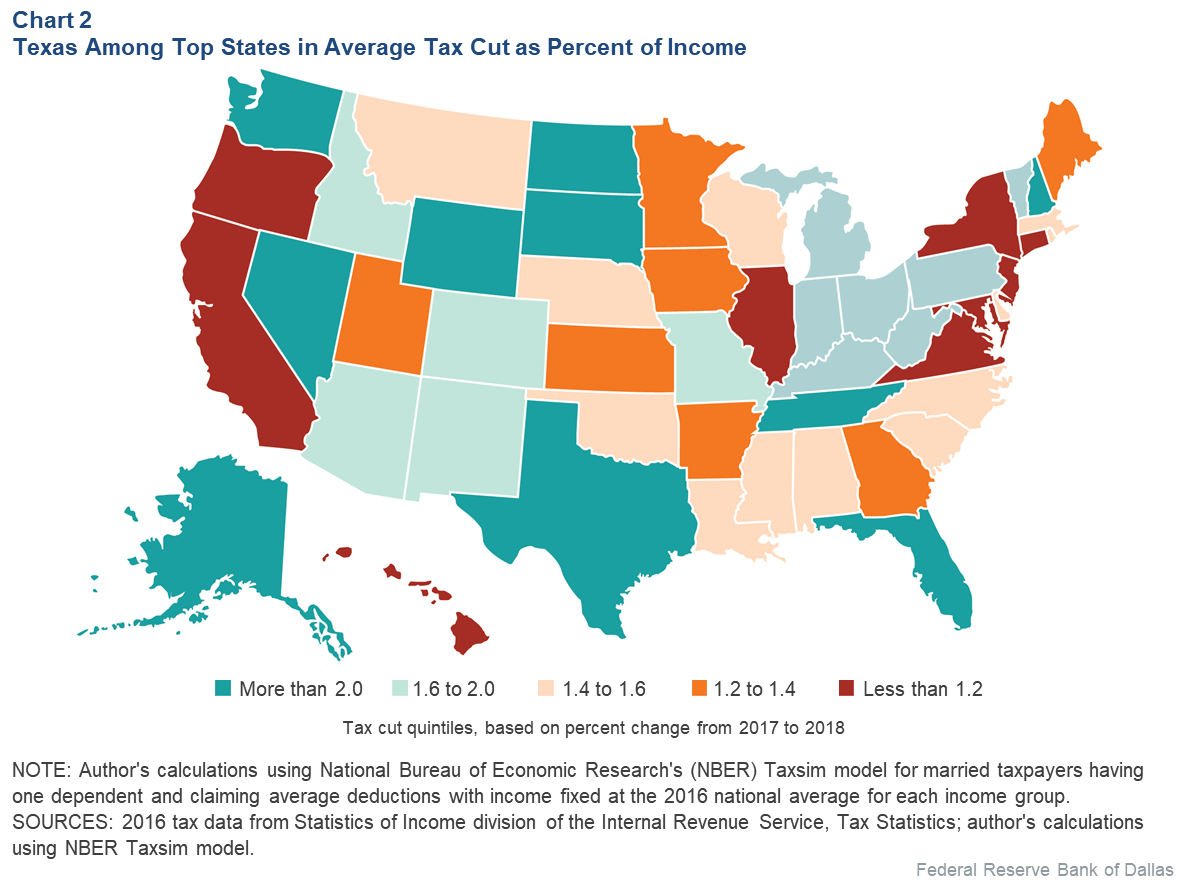

Texas Sees Job Output Gains From 2018 U S Tax Cut Dallasfed Org

Capital Gains Tax On Property Sales In Texas Tom S Texas Realty

How Taxes In Texas Compare To Other States Guide To Texas Property Tax Comparison Tax Ease

The 11 Best Neighborhoods To Live In Dallas In 2022 2022 Bungalow

Amazon Fba Sales Tax Made Easy A 2022 Guide

Taxes In Dallas Texas Teleport Cities

Most Texans Pay More In Taxes Than Californians Reform Austin

Dallas Real Estate Property Tax Rates

Texas Tax Rates Rankings Texas State Taxes Tax Foundation

How The Increasing Income Gap In The Dallas Fort Worth Region Threatens Everyone Dallas Business Journal

Surviving Off A 400k Income Joe Biden Deems Rich For Higher Taxes